Are solar panels free?

Someone may have knocked on your door, or you may have seen an ad promoting free solar panels. Sounds too good to be true, right? Let’s find out, but here’s a hint: The familiar adage of “There is no such thing as a free lunch” still applies.

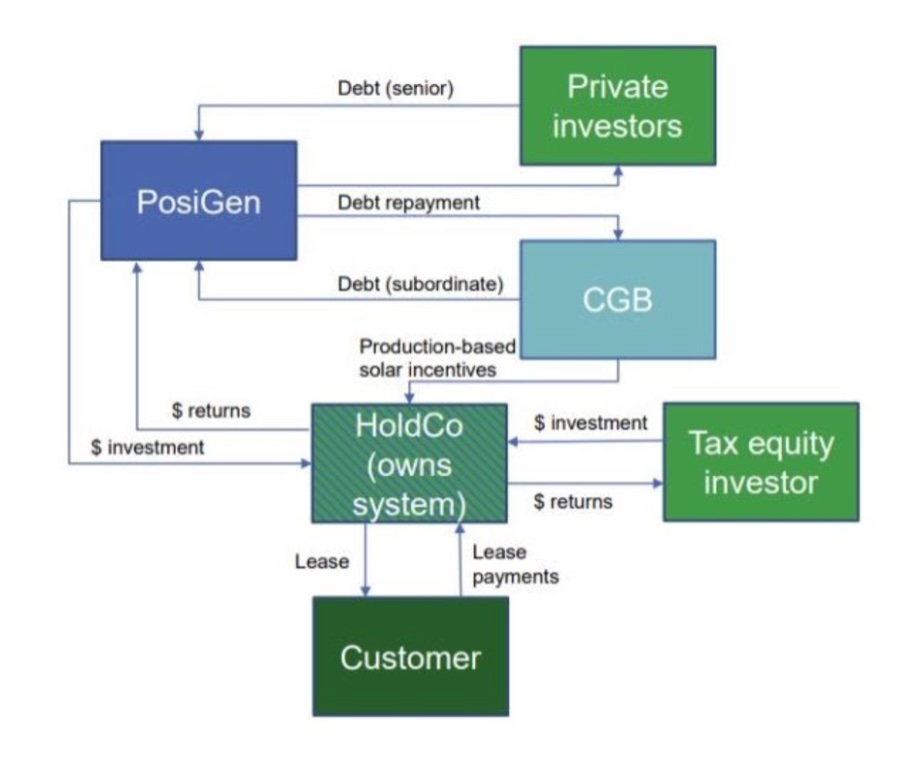

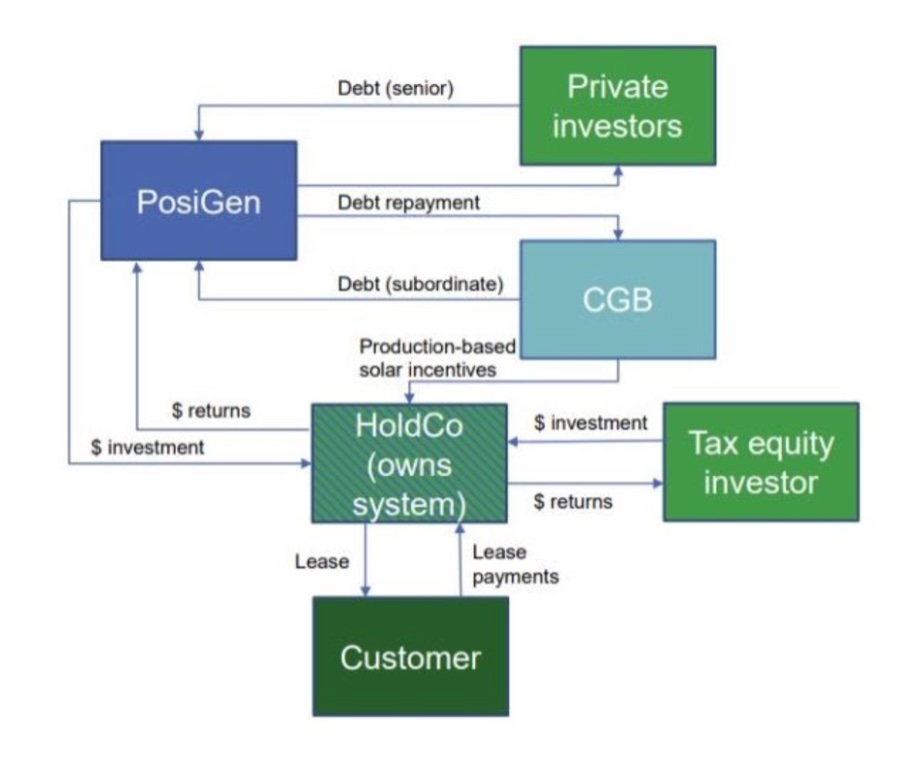

This arrangement is what the industry calls “third-party ownership” where a third-party pays to install a system on your property. They own and operate the system and collect all of the incentives. Then they sell you the electricity the system generates at a fixed monthly cost (a “solar lease”) or a fixed electricity price per kilowatt-hour (a “solar power purchase agreement” or PPA). Behind the scenes third-party ownership involves multiple parties and complex structures as you can see by the example below.

Source: PV Magazine

Are solar panels free?

Someone may have knocked on your door, or you may have seen an ad promoting free solar panels. Sounds too good to be true, right? Let’s find out, but here’s a hint: The familiar adage of “There is no such thing as a free lunch” still applies.

This arrangement is what the industry calls “third-party ownership” where a third-party pays to install a system on your property. They own and operate the system and collect all of the incentives. Then they sell you the electricity the system generates at a fixed monthly cost (a “solar lease”) or a fixed electricity price per kilowatt-hour (a “solar power purchase agreement” or PPA). Behind the scenes third-party ownership involves multiple parties and complex structures as you can see by the example below.

Source: PV Magazine

When you might consider a solar lease or solar PPA

While you’re almost always better off owning your own home solar system, there are a few scenarios where a solar lease or PPA might make sense:

When you might consider a solar lease or solar PPA

While you’re almost always better off owning your own home solar system, there are a few scenarios where a solar lease or PPA might make sense:

Why solar leases and PPAs don’t make sense for most homeowners

Here’s why most homeowners are better off owning their home solar system. When you sign a solar lease or solar PPA…

Why solar leases and PPAs don’t make sense for most homeowners

Here’s why most homeowners are better off owning their home solar system. When you sign a solar lease or solar PPA…

What are my options for purchasing solar panels?

The cost of installing solar panels varies widely based on a variety of real factors, but even comparable systems in the same area can be priced very differently. We outline all the factors that affect solar panels’ cost here, but you can expect to pay $20,000 to $30,000 for a typical residential solar panel system.

$20,000 to $30,000 is a significant investment! However, if you want to take full advantage of the savings offered by a solar panel system by owning it yourself, you have several options for purchasing a system. The good news is that even if you don’t have cash sitting in your bank account to pay for a home solar system, you have many options available to finance a home solar purchase.

Before we get into the details, it’s important to start with a basic understanding of your current financial situation and your financial goals. Here are a few questions to ask yourself:

We’ll discuss each of the options to finance a home solar purchase in more detail below.

What are my options for purchasing solar panels?

The cost of installing solar panels varies widely based on a variety of real factors, but even comparable systems in the same area can be priced very differently. We outline all the factors that affect solar panels’ cost here, but you can expect to pay $20,000 to $30,000 for a typical residential solar panel system.

$20,000 to $30,000 is a significant investment! However, if you want to take full advantage of the savings offered by a solar panel system by owning it yourself, you have several options for purchasing a system. The good news is that even if you don’t have cash sitting in your bank account to pay for a home solar system, you have many options available to finance a home solar purchase.

Before we get into the details, it’s important to start with a basic understanding of your current financial situation and your financial goals. Here are a few questions to ask yourself:

We’ll discuss each of the options to finance a home solar purchase in more detail below.

Cash or home equity financing

Paying cash will get you the best price and best return on your home solar investment because you won’t have to pay fees or interest, which will eat away at your financial return. If you’re thinking of paying cash, you’ll first want to consider other uses for that cash. Are there other big-ticket items that you’ll want to purchase in the next few years? After a cash purchase, will you still have a comfortable cushion of savings in the bank in case of an emergency?

If you decide to pay cash, you’ll want to pay attention to the estimated payback of the solar panel system. For example, an eight-year payback means that you’ll have recouped the amount you paid for the system in eight years. Remember that solar panel systems come with 25 year warranties and there’s a good chance that they could last longer.

The second most efficient way to purchase solar is to use a home equity loan or line of credit. The fees and interest on home equity loans or lines of credit are much less than those of a solar loan since they are secured by your home AND the interest you pay may be tax-deductible (consult your tax professional to determine what you can deduct on your taxes).

When considering a home solar purchase financed by home equity, you’ll want to compare your monthly repayment obligation to the estimated monthly energy savings. If you can save as much or more than your monthly repayment, your home solar system is effectively paying for itself.

Cash or home equity financing

Paying cash will get you the best price and best return on your home solar investment because you won’t have to pay fees or interest, which will eat away at your financial return. If you’re thinking of paying cash, you’ll first want to consider other uses for that cash. Are there other big-ticket items that you’ll want to purchase in the next few years? After a cash purchase, will you still have a comfortable cushion of savings in the bank in case of an emergency?

If you decide to pay cash, you’ll want to pay attention to the estimated payback of the solar panel system. For example, an eight-year payback means that you’ll have recouped the amount you paid for the system in eight years. Remember that solar panel systems come with 25 year warranties and there’s a good chance that they could last longer.

The second most efficient way to purchase solar is to use a home equity loan or line of credit. The fees and interest on home equity loans or lines of credit are much less than those of a solar loan since they are secured by your home AND the interest you pay may be tax-deductible (consult your tax professional to determine what you can deduct on your taxes).

When considering a home solar purchase financed by home equity, you’ll want to compare your monthly repayment obligation to the estimated monthly energy savings. If you can save as much or more than your monthly repayment, your home solar system is effectively paying for itself.

Loan financing

If you don’t have cash or home equity financing available or those funds are earmarked for something else, solar loans are a good way to finance the purchase of a home solar system. Solar loans work the same way as loans for other purchases, and generally, if your credit score is above 650, you’ll qualify for a solar loan. Loans can come from a bank, a credit union, a utility, or other financial institution and sometimes may be subsidized by a state or utility program.

When financing your home solar with a loan, it’s important to know that most loans have “dealer fees” which a contractor pays when they sell a loan. These dealer fees are passed along to the customer and are typically not disclosed to homeowners. If you’ve ever had a contractor offer you a “cash discount”, chances are they are offering that discount because they won’t have to pay the dealer fee if you pay cash.

Dealer fees are based on a percentage of the purchase price of the system. So a 20 percent dealer fee on a $30,000 system will be $6,000 ($30,000 x 20%). Dealer fees will vary based on the length of the loan, with longer duration loans having higher dealer fees, but the more significant driver of the dealer fee is the interest rate of the loan. So a solar loan with a 2.99 percent interest rate will have a higher dealer fee than a solar loan with a 5.99 percent interest rate. Dealer fees can reach as high as 30 percent of the system cost, so it’s essential that you’re aware of the impact of these fees and that your solar contractor has a relationship with a reputable loan provider.

Many solar loans offer an interest-free portion of the loan, which is equivalent to your expected tax credit (30% of the total system cost), allowing you to pay back that portion of the loan when you receive your tax credit. If considering a solar loan with this type of structure, it’s important to understand what your initial monthly payments will be versus your monthly payments after repayment of the tax credit since your monthly payment will decrease after you pay off the tax credit portion of the loan.

For solar loans, the bottom line is essentially the same as with home equity financing – if your monthly energy savings from solar is equal to or more than your monthly loan repayment, your home solar system is effectively paying for itself. Once the solar loan is paid off, you own the system free and clear and keep all of the energy savings and incentives for the remaining lifetime of the system.

Loan financing

If you don’t have cash or home equity financing available or those funds are earmarked for something else, solar loans are a good way to finance the purchase of a home solar system. Solar loans work the same way as loans for other purchases, and generally, if your credit score is above 650, you’ll qualify for a solar loan. Loans can come from a bank, a credit union, a utility, or other financial institution and sometimes may be subsidized by a state or utility program.

When financing your home solar with a loan, it’s important to know that most loans have “dealer fees” which a contractor pays when they sell a loan. These dealer fees are passed along to the customer and are typically not disclosed to homeowners. If you’ve ever had a contractor offer you a “cash discount”, chances are they are offering that discount because they won’t have to pay the dealer fee if you pay cash.

Dealer fees are based on a percentage of the purchase price of the system. So a 20 percent dealer fee on a $30,000 system will be $6,000 ($30,000 x 20%). Dealer fees will vary based on the length of the loan, with longer duration loans having higher dealer fees, but the more significant driver of the dealer fee is the interest rate of the loan. So a solar loan with a 2.99 percent interest rate will have a higher dealer fee than a solar loan with a 5.99 percent interest rate. Dealer fees can reach as high as 30 percent of the system cost, so it’s essential that you’re aware of the impact of these fees and that your solar contractor has a relationship with a reputable loan provider.

Many solar loans offer an interest-free portion of the loan, which is equivalent to your expected tax credit (30% of the total system cost), allowing you to pay back that portion of the loan when you receive your tax credit. If considering a solar loan with this type of structure, it’s important to understand what your initial monthly payments will be versus your monthly payments after repayment of the tax credit since your monthly payment will decrease after you pay off the tax credit portion of the loan.

For solar loans, the bottom line is essentially the same as with home equity financing – if your monthly energy savings from solar is equal to or more than your monthly loan repayment, your home solar system is effectively paying for itself. Once the solar loan is paid off, you own the system free and clear and keep all of the energy savings and incentives for the remaining lifetime of the system.

How do I decide what financing to use for my home solar system?

Like any other purchase (a car for example), how you decide to finance that purchase is very specific to your current financial situation and future financial plans and goals. You need to understand both the costs and terms associated with your financing options as well as the financial benefits provided by your home solar system (energy savings, rebates and incentives). Here are some questions to think through:

How do I decide what financing to use for my home solar system?

Like any other purchase (a car for example), how you decide to finance that purchase is very specific to your current financial situation and future financial plans and goals. You need to understand both the costs and terms associated with your financing options as well as the financial benefits provided by your home solar system (energy savings, rebates and incentives). Here are some questions to think through:

We understand that whether you purchase a home solar system and how you choose to finance that purchase will have a significant impact on your finances and we’re here to help.

Learn more about how we help homeowners evaluate their home solar purchase options here, or get started with a free Home Solar Assessment by clicking below.

We understand that whether you purchase a home solar system and how you choose to finance that purchase will have a significant impact on your finances and we’re here to help.

Learn more about how we help homeowners evaluate their home solar purchase options here, or get started with a free Home Solar Assessment by clicking below.

Have questions on home solar financing or anything else? Send us a message and we’ll answer ASAP.

Have questions on home solar financing or anything else? Send us a message and we’ll answer ASAP.

Learn about solar

Find honest answers to some of the most commonly asked questions on home solar and clean energy.