Solar PV recycling market to be worth $2.7 billion by 2030

Photo courtesy of Sinovoltaics

July 6, 2022

Recycling solar panels is one of the two biggest sustainability issues facing the solar industry (the other; energy payback is seemingly settled for now). With a 25 year+ lifetime and most of the world’s solar having been installed in the last 10 years, we have a little bit of time to figure out what to do with solar panels which have reached the end of their usable life before the volume of defunct panels becomes a significant issue.

While the EU and some states (like Washington) have taken steps to regulate solar panel recycling and at least one solar panel manufacturer (US-based First Solar) has an in-house solar panel recycling program, the broader industry doesn’t have an answer just yet. Regulations and voluntary programs are great, but unless the market demands it (and is willing to pay for it) or it becomes financially viable (ie. companies can make money from it) it’s simply not going to happen in the volume that we need it to. If companies can make money by recycling solar panels, the equation changes from one where recycling is a cost to the industry to one where recycling becomes valuable and where there’s money to be made, a lot more recycling is going to happen naturally.

However, in order for money to be made in solar panel recycling, the cost of the recovered materials needs to be at least at, if not below the cost of virgin materials. And solar panel manufacturers have spent the last two decades driving down their manufacturing and material costs. So this analysis by Rystad Energy showing that the value of the materials that’s able to be recovered by solar panels will grow exponentially in the coming decade is a ray of hope that a financially sound business case can be made for recycling solar panels.

Before we let you go, we’d be remiss if we didn’t mention that the best way to address the issue of solar panel waste (and improve the return on a solar investment!) is to make solar panels last a lot longer. There are two ways to do that: The first is to find ways to refurbish solar panels to extend their lifetime and the second is to make solar panels more robust so that they last longer. There’s good work happening in both these areas and we may soon see solar panels with 50-year lifetimes!

Here’s a link to a great organization that is working to make solar panel recycling and donation more accessible as well as a link to the original article. You can also read the original article’s full text below.

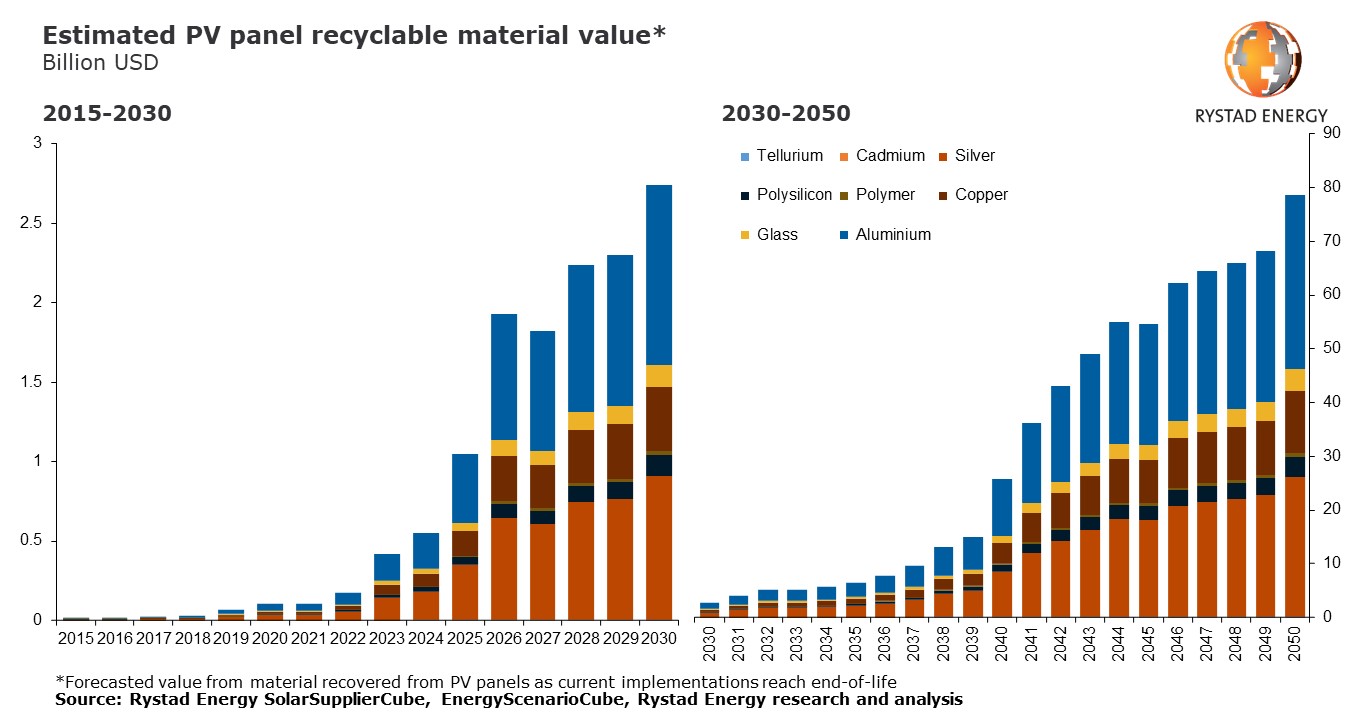

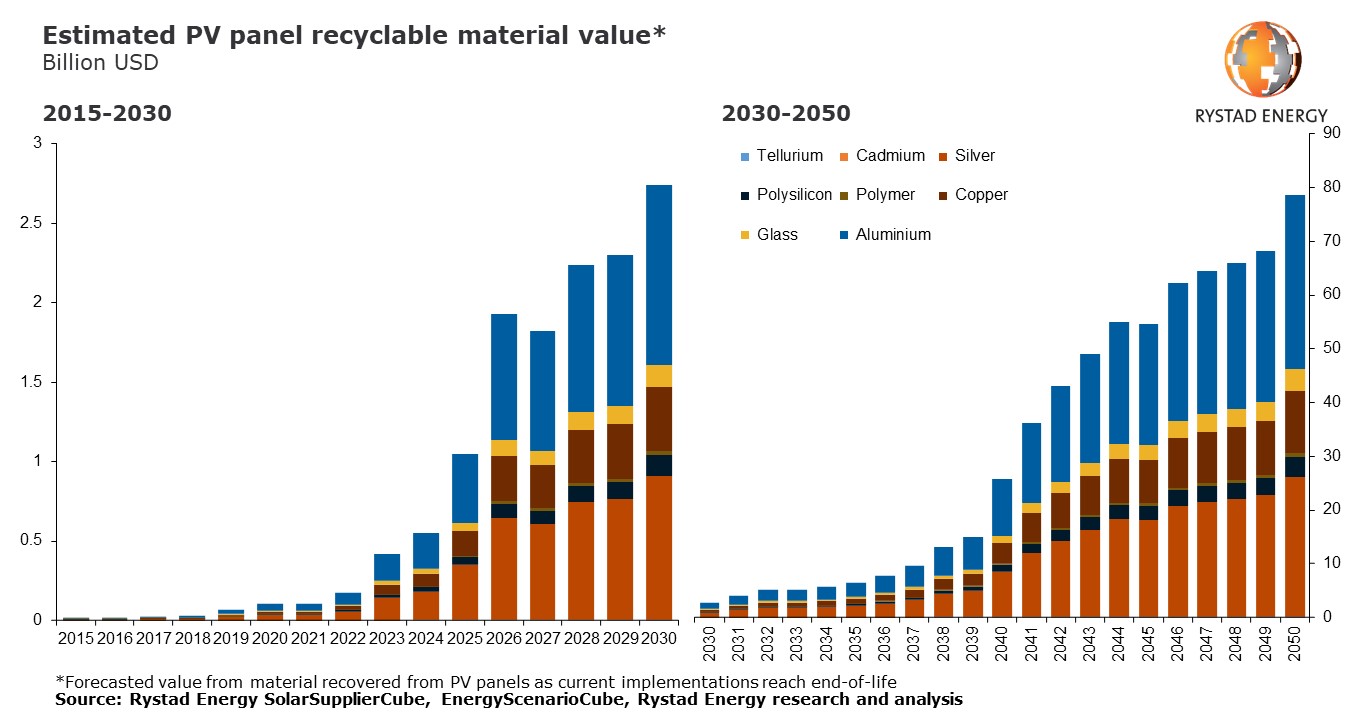

The demand for recycled solar photovoltaic (PV) panel components is set to skyrocket in the coming years as the number of installations surges and the threat of a supply bottleneck looms. Rystad Energy analysis shows recyclable materials from PV panels at the end of their lifespan will be worth more than $2.7 billion in 2030, up from only $170 million this year. This trend will only accelerate in the coming decades and the value of recyclable materials is projected to approach $80 billion by 2050.

PV recycling is still in its infancy but is seen as an essential element of the energy transition, with solar PV waste projected to grow to 27 million tonnes per annum by 2040. Our forecasts show that recovered materials from retired panels could make up 6% of solar PV investments by 2040, compared to only 0.08% today.

Landfills are an easy and cheap option as current resale prices for recycled solar PV materials do not compensate for the transportation, sorting and processing costs. Yet, the rapid growth rate of large-scale utility farms within solar energy can change this. The material supply side is expected to encounter bottlenecks with the growing demand for minerals, and recycling can be a supply relief as panels reach the end-of-life stage.

“Rising energy costs, improved recycling technology, and government regulations may pave the way for a market where more defunct solar panels are sent to recycling rather than the nearest landfill. Recycling PV panels can help operators save costs, overcome supply chain woes and increase the likelihood of countries meeting their solar capacity goals,” says Rystad Energy analyst Kristin Stuge.

Image courtesy of Rystad Energy

Demand for the materials and minerals used in solar PV is set to climb with the energy transition, with higher prices a likely result. The International Energy Agency’s net-zero emissions scenario targets 40% of the world’s power in 2050 being generated by solar energy – equivalent to 19 terawatts (TW). However, our 1.6 degrees Celsius (°C) scenario predicts that 53% will be solar-generated, a trend seen in the numbers and size of plant installments.

By assuming a 15-year lifespan of a PV panel and analyzing installation activity in 2022, we can estimate which regions and countries will benefit most from recycling PV materials in 2037. China is set to account for 40% of global installations this year, and when these panels mature in 15 years, the estimated recycling value will be $3.8 billion, out of a $9.6 billion global total. India – another Asian solar PV powerhouse – will trail in second place with an estimated $800 million in value, followed by Japan with $200 million in estimated value. Trailing the Asian continent, the value of recyclable material in North America in 2037 is projected to be worth $1.5 billion, with Europe set to hold $1.4 billion.

What can be recycled?

The panel components with the highest value are aluminum, silver, copper and polysilicon. Silver accounts for about 0.05% of the total weight but makes up 14% of the material value. Polysilicon is obtained through an energy intensive process to achieve the concentration needed for solar panel efficiency, reflected in the relatively high resale price. The greatest volume of material is glass, which has a high recycling rate but relatively low resale value.

An influx of minerals is necessary to decarbonize global energy systems and prevent valuable material loss in standardized waste streams. Rystad Energy’s 1.6°C scenario estimates peak solar energy implementation in 2035 of 1.4 TW. By that time, the PV recycling industry can supply 8% of the polysilicon, 11% of the aluminum, 2% of the copper, and 21% of the silver needed by recycling PV panels installed in 2020 to meet the demand for materials. This recovery potential can ease strains on the mining sector and reduce the solar PV panels’ carbon footprint. The process of refining copper releases about 4 tonnes of carbon dioxide (CO2) per tonne of copper and is, together with the broader mining industry, a significant source of greenhouse gas emissions. Potential future carbon taxes can change the cost situation with significant value gains for the recycling industry.

How are materials recycled?

The first step of PV panel recycling is disassembly, where the aluminum frame and junction box are separated from the panel, ground into pieces, and sorted by material. There are PV disassembly machines on the market today, including one by Japan-based NPC, which separates the panel parts even further before grinding the remains, enhancing the recovery rate for materials. With evolving technology, the market is gradually perceived with greater enthusiasm, and new companies are emerging, such as the US-based start-up SolarCycle, which has generated significant seed funding from investors.

Technology, policy and economic viability are both barriers and solutions to evolving circularity of minerals in the PV panel industry. Regulatory mechanisms can be an efficient tool to create rapid change, as we have already seen in the European market and through some initial attempts in the US at the state level. Ultimately, bottlenecks and long lead times in raw material mining could turn solar PV recycling into an economically viable industry in the coming decades.

Solar PV recycling market to be worth $2.7 billion by 2030

Photo courtesy of Sinovoltaics

July 6, 2022

Recycling solar panels is one of the two biggest sustainability issues facing the solar industry (the other; energy payback is seemingly settled for now). With a 25 year+ lifetime and most of the world’s solar having been installed in the last 10 years, we have a little bit of time to figure out what to do with solar panels which have reached the end of their usable life before the volume of defunct panels becomes a significant issue.

While the EU and some states (like Washington) have taken steps to regulate solar panel recycling and at least one solar panel manufacturer (US-based First Solar) has an in-house solar panel recycling program, the broader industry doesn’t have an answer just yet. Regulations and voluntary programs are great, but unless the market demands it (and is willing to pay for it) or it becomes financially viable (ie. companies can make money from it) it’s simply not going to happen in the volume that we need it to. If companies can make money by recycling solar panels, the equation changes from one where recycling is a cost to the industry to one where recycling becomes valuable and where there’s money to be made, a lot more recycling is going to happen naturally.

However, in order for money to be made in solar panel recycling, the cost of the recovered materials needs to be at least at, if not below the cost of virgin materials. And solar panel manufacturers have spent the last two decades driving down their manufacturing and material costs. So this analysis by Rystad Energy showing that the value of the materials that’s able to be recovered by solar panels will grow exponentially in the coming decade is a ray of hope that a financially sound business case can be made for recycling solar panels.

Before we let you go, we’d be remiss if we didn’t mention that the best way to address the issue of solar panel waste (and improve the return on a solar investment!) is to make solar panels last a lot longer. There are two ways to do that: The first is to find ways to refurbish solar panels to extend their lifetime and the second is to make solar panels more robust so that they last longer. There’s good work happening in both these areas and we may soon see solar panels with 50-year lifetimes!

Here’s a link to a great organization that is working to make solar panel recycling and donation more accessible as well as a link to the original article. You can also read the original article’s full text below.

The demand for recycled solar photovoltaic (PV) panel components is set to skyrocket in the coming years as the number of installations surges and the threat of a supply bottleneck looms. Rystad Energy analysis shows recyclable materials from PV panels at the end of their lifespan will be worth more than $2.7 billion in 2030, up from only $170 million this year. This trend will only accelerate in the coming decades and the value of recyclable materials is projected to approach $80 billion by 2050.

PV recycling is still in its infancy but is seen as an essential element of the energy transition, with solar PV waste projected to grow to 27 million tonnes per annum by 2040. Our forecasts show that recovered materials from retired panels could make up 6% of solar PV investments by 2040, compared to only 0.08% today.

Landfills are an easy and cheap option as current resale prices for recycled solar PV materials do not compensate for the transportation, sorting and processing costs. Yet, the rapid growth rate of large-scale utility farms within solar energy can change this. The material supply side is expected to encounter bottlenecks with the growing demand for minerals, and recycling can be a supply relief as panels reach the end-of-life stage.

“Rising energy costs, improved recycling technology, and government regulations may pave the way for a market where more defunct solar panels are sent to recycling rather than the nearest landfill. Recycling PV panels can help operators save costs, overcome supply chain woes and increase the likelihood of countries meeting their solar capacity goals,” says Rystad Energy analyst Kristin Stuge.

Image courtesy of Rystad Energy

Demand for the materials and minerals used in solar PV is set to climb with the energy transition, with higher prices a likely result. The International Energy Agency’s net-zero emissions scenario targets 40% of the world’s power in 2050 being generated by solar energy – equivalent to 19 terawatts (TW). However, our 1.6 degrees Celsius (°C) scenario predicts that 53% will be solar-generated, a trend seen in the numbers and size of plant installments.

By assuming a 15-year lifespan of a PV panel and analyzing installation activity in 2022, we can estimate which regions and countries will benefit most from recycling PV materials in 2037. China is set to account for 40% of global installations this year, and when these panels mature in 15 years, the estimated recycling value will be $3.8 billion, out of a $9.6 billion global total. India – another Asian solar PV powerhouse – will trail in second place with an estimated $800 million in value, followed by Japan with $200 million in estimated value. Trailing the Asian continent, the value of recyclable material in North America in 2037 is projected to be worth $1.5 billion, with Europe set to hold $1.4 billion.

What can be recycled?

The panel components with the highest value are aluminum, silver, copper and polysilicon. Silver accounts for about 0.05% of the total weight but makes up 14% of the material value. Polysilicon is obtained through an energy intensive process to achieve the concentration needed for solar panel efficiency, reflected in the relatively high resale price. The greatest volume of material is glass, which has a high recycling rate but relatively low resale value.

An influx of minerals is necessary to decarbonize global energy systems and prevent valuable material loss in standardized waste streams. Rystad Energy’s 1.6°C scenario estimates peak solar energy implementation in 2035 of 1.4 TW. By that time, the PV recycling industry can supply 8% of the polysilicon, 11% of the aluminum, 2% of the copper, and 21% of the silver needed by recycling PV panels installed in 2020 to meet the demand for materials. This recovery potential can ease strains on the mining sector and reduce the solar PV panels’ carbon footprint. The process of refining copper releases about 4 tonnes of carbon dioxide (CO2) per tonne of copper and is, together with the broader mining industry, a significant source of greenhouse gas emissions. Potential future carbon taxes can change the cost situation with significant value gains for the recycling industry.

How are materials recycled?

The first step of PV panel recycling is disassembly, where the aluminum frame and junction box are separated from the panel, ground into pieces, and sorted by material. There are PV disassembly machines on the market today, including one by Japan-based NPC, which separates the panel parts even further before grinding the remains, enhancing the recovery rate for materials. With evolving technology, the market is gradually perceived with greater enthusiasm, and new companies are emerging, such as the US-based start-up SolarCycle, which has generated significant seed funding from investors.

Technology, policy and economic viability are both barriers and solutions to evolving circularity of minerals in the PV panel industry. Regulatory mechanisms can be an efficient tool to create rapid change, as we have already seen in the European market and through some initial attempts in the US at the state level. Ultimately, bottlenecks and long lead times in raw material mining could turn solar PV recycling into an economically viable industry in the coming decades.

Have a question about solar panel recycling or anything else? Send us a message and we’ll answer ASAP.

Have a question about solar panel recycling or anything else? Send us a message and we’ll answer ASAP.